Approaching the end of 2020, it is perhaps appropriate to put the investment year into perspective.

Because this is an investment note, because Coherent is an investment business and because, at Coherent, our emphasis is on the analysis of price behaviour, I am going to confine my comments to observations on price behaviour. There are many people better qualified than I am to comment on Covid-19. And there are also many who are not qualified at all to comment on Covid-19 but who will do so anyway.

In late February and early March 2020, the JSE Top40 index fell by 36% in characteristic bear market free-fall. It then recovered most of this loss in approximately 5 months.

So how unusual is this price action?

Human memories are short and selective. This is understandable in the context of information overload in the digital era and also our species’ natural optimism. In investments we often take the childish approach of hoping that, if we ignore something unpleasant – if we look away – then it will not be there when we look back. The monster will not really be under the bed or in the cupboard or wherever monsters usually lurk.

However, the more mature approach, hopefully exhibited by adults, is to turn the lights on and examine the beds and the cupboards to prove “no monsters here.” There may be some spiders or other creepy crawlies, but they can be dealt with when we know what & where they are.

So, let’s put a little adult illumination on the March 2020 JSE monster: It was a bear market. This was real, not imaginary.

The conventional definition of a bear market is a fall of at least 20% that lasts for at least 2 months.

Well, the JSE Top 40 index topped out in late 2017 and had been making successively lower highs for over 2 years. March 2020 was the blow-off finale. In a spectacular bounce of over 66% it has just regained its’ 2017 high.

Is this bear market finished? Who knows?

But what can we learn from the data?

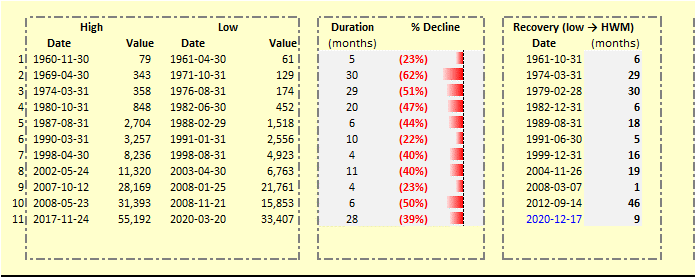

Listed below are all the bear markets on the JSE since 1960. I selected 1960 for no better reason than because it was the year that I was born. I have since seen and traded through a number of bear markets since my start in the financial markets in the late 1980’s. Note that the South African experience largely mirrors the international experience.

JSE bear markets (1960 – 2020)

Some simple eyeballing and some simple arithmetic help make sense of this data.

Just looking at the data superficially, I have traded through the 1987 crash (44%), the 1997/8 emerging market crisis (40%) and the 2008 GFC (50%). There seems to be a pattern here … a good ‘klap’ every 10 years. Why is anyone surprised that, another ten years later, the JSE has again fallen (40%) since its 2017 high?

Some Averages

To arithmetically simplify the table, let’s calculate some averages and aggregate the data;

- There have been 11 bear markets in 60 years i.e. on average one every 5 or 6 years, with a larger one every decade.

- The average bear market is a fall of (40%) that takes 14 months to bottom out. These bear markets make up 22% of the 60 years data.

- The recoveries from bear market lows to previous high-water marks take 25% of the same 60 years. Note that a bounce from the low to the High Water Mark is a recovery. Profits begin after the High Water Mark (previous high) is exceeded, not from the bottom of a bear market.

- So, in the last 60 years, the JSE equity market has spent 47% of the time either in bear markets or recovering from bear markets.

- Bear in mind that most market capitalisation weighted indices are typically stronger than the broader market as they upweight the more successful stocks and down weight the less successful ones. So, the broad experience will be poorer than the index. This is a large part of the argument for holding ETF’s.

Market & Medical Clichés

This does of course make one question the old masochistic market cliche of “it’s time in the market, not timing the market.” Why spend all your time fully invested in an asset class that spends half its time in, or recovering from, bear markets?

Far more appropriate is the medical doctors’ Hippocratic oath of “first, do no harm” i.e. first, don’t lose money. Have a well thought out risk management plan and implement it rigorously.

In the next article we will take a look at the implications of this bear market data for investment returns.

Author: Andy Pfaff

Download a PDF version of this article.