“Those who fail to learn from history are condemned to repeat it.”

(Winston Churchill, 1948)

‘Bear Markets are Real’ – a brief summary

- Over the last 60 years, the JSE has had a technical bear market roughly every 5 years, with a more significant bear market roughly every 10 years. This is very similar to the international data.

- The average bear market has resulted in a 40% loss of capital. A quarter of these bear markets have resulted in losses of 50% or more.

- Over this period the JSE equity market has spent almost half the time either in a bear market or recovering from a bear market.

- Over this period JSE investors have earned approximately 14% p.a. at an average risk (30 day volatility) of approximately 20% i.e. investors have earned 70 cents of return for every unit of risk taken.

These experiences have meaningful implications for investors, some of which are explored below.

Bear Market Arithmetic

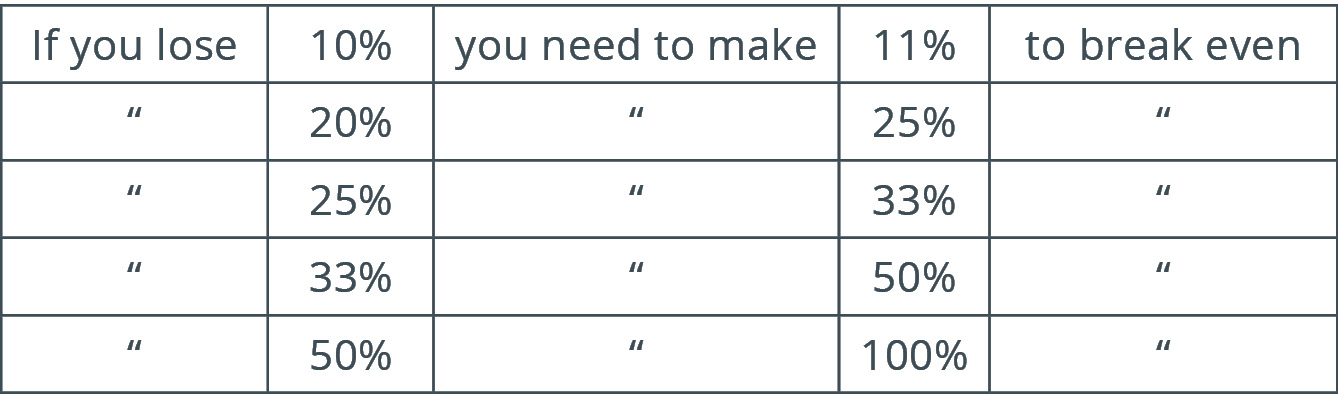

The following table is simple but often ignored:

The average bear market of 40% therefore requires a 66% return to break even. Note that this 66% return only recoups the lost capital. It ignores the erosive effect of inflation and the returns which were budgeted for this period.

The bad news does not end yet (i) Risk appetite

For those investors completing their risk profiles (moderate, medium or aggressive?) give some thought to the following: how much risk does an investor need to take to earn this 66% return? And, remember, this is just to break even.

As per summary point 4 above, the JSE equity market has earned approximately 14% p.a. at a risk (volatility) of approximately 20% over the last 60 years.

To recoup a loss of 40% over the following year, an investor will need to take 66% x (20/14) risk – in other words in investor would need to risk everything in pursuit of this goal. Note that it is not possible take more risk than the market offers if the investor is following a traditional investment strategy that does not make use of leverage.

The bad news does not end yet (ii) Obligatory capital withdrawals

As unfortunate as a bear market may be for investors who must suffer through it, it can get worse for some. If an investor is obliged to withdraw capital from the invested money before the loss is recouped, then the losses must be recouped with less capital.

Take, for example, an investor who has R100 invested in the stock market. After an average bear market loss of 40% the investor has R60 remaining. However, what if the investor needs to withdraw R20 for some life event (e.g. a child’s education expenses). That redemption would have represented 20% of the pre-bear capital, but it now represents 20/60 = 33% of the post-bear market capital. After withdrawing the R20, the investor only has R40 capital remaining. To rebuild the capital back up to R100 requires R60/R40 = 150% return.

The bad news does not end yet (iii) Time is money

These calculations above ignore the return that an investor expected to make over this period. For example, if your financial planning assumes an annual return of 10% and the average bear market and its subsequent recovery together take 2.5 years, then you need to add another 2.5 years x 10% = 25% to the 66% breakeven recovery to get to the position that the financial planning assumed. That means the investor requires 66% + 25% = 91% return to get back on track (ignoring compounding for simplicity’s sake).

What can be learned from Bear Markets and Bear Market Arithmetic so that we are not condemned (a la Churchill) to repeat the cycle every decade?

Memories are short. The 2020 bear market & recovery are one of the fastest on record. A real bear market can be a generational affair. The Japanese Nikkei Dow equity index topped out in 1990 at 40 000 but fell to 7 500 over the next decade. The Nikkei is now at approximately 25 000, up approximately 300% from its low. However, it still needs to double before it will reach its high water mark of 30 years ago.

As discussed above, recouping capital losses is both risky and hard work. However, it is possible to invest in a way that is not based on taking huge risk to recover losses. “It’s time in the market not timing the market” is a very masochistic, but widely propagated market cliché. Far better is the doctor’s Hippocratic Oath of “First do no harm.”

If you take less risk most of the time, then you don’t have to take so much risk trying to recover lost money and lost time.

If you manage risk better, you will lose less capital in bear markets. Then you will not need to take so much risk trying to recoup such large losses. Instead, you can profit from the ensuing bull market, instead of needing it to recover losses.

It’s not so bad … there is a choice: adopt a risk-aware investment approach:

All investors should remember the following points when making their investment decisions:

1. High portfolio risk does not automatically result in high returns.

a. High portfolio risk just means high portfolio risk.

b. While history suggests that investors can earn a premium for taking risk over time – there is just no certainty as to when this might happen.

2. Know how much risk your portfolio is taking.

a. Take risk deliberately. Do not just ‘inherit’ risk as a by-product of uninformed investment choices.

3. Know where the risk is in your portfolio:

a. What the probability is of that risky scenario occurring? and

b. What is the expected payoff if the worst-case scenario plays out?

Being risk aware and intelligently incorporating this awareness into your investment process offers a way to successfully compound returns by “first doing no harm” to your portfolio.

In the following articles we will take a look at the implications of Bear Market data and Bear Market arithmetic for investment strategy and investment returns.

For more information on this article or any of the Coherent Capital Management investment solutions please contact either enquiries@coherentcm.com or Wendy Funnell at wendy.funnell@coherentcm.com

Author: Andy Pfaff

Download a PDF version of this article.