Systematic investing is a term that can (and does) mean many different things to different people. Concepts like ‘quant investing’, ‘algos’ or ‘high frequency trading’ (HFT) often come to mind when people hear this term. We follow a systematic investment process at Coherent Capital Management (“CCM”), and that we believe it is a fundamentally important part of what determines our funds’ investment outcomes. It is therefore important to present our perspective of what this term means to us and how we believe that investing on a systematic basis adds value to our investment process.

Investing: the difference between ‘What do to’ and ‘how to do it’

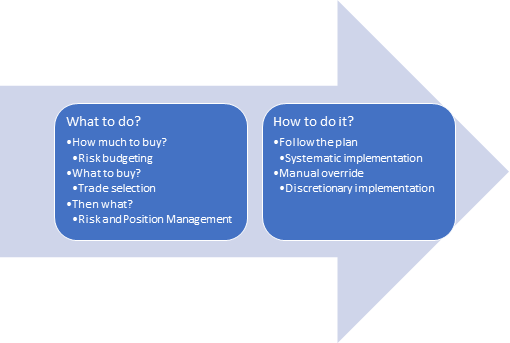

One of the key reasons for the proliferation of interpretations and use of this term is the conflation of two related, but fundamentally different elements of the investment process. These are summarised in Figure One.

Figure One: ‘What to do’ vs. ‘How to do it’

The first part of the investment process is working out how to answer the following three key investment questions:

- How much to buy (risk budgeting)?

- What to buy (trade selection)?

- Then what (position management)?

These decisions can be codified i.e. defined in terms of a set of rules, or they can be discretionary, often reflecting a set of principles, but leaving a lot of discretion in terms of the interpretation of the rules in different contexts.

CCM’s approach to these investment decisions is explained in detail in this article. This discussion clearly outlines the systematic nature of this process.

The second part of the process concerns the implementation of these investment decisions on an ongoing basis. There are two different ways to do this – systematically (consistently) or on a discretionary basis.

- Systematic implementation refers to a process which is repeated consistently i.e. there a plan for the implementation of the investment decision-making process and there is no choice in how it is done. Every day, every decision is made in the same way – the same process is always followed.

- Discretionary implementation refers to a process whereby judgement is used in terms of the implementation of the rules. Every day might be different.

What, then, is systematic investing?

The key source of the confusion on the topic is that the term “systematic investing” as a description is lazily applied to both parts of the investment process. This is illustrated in Figure Two. However, to be truly systematic both these processes must be systematic (as defined above). This distinction has not always been made clear.

Figure Two: The Discretionary-Systematic investment management framework

Take, for example, take the case of index tracking investment solutions: all their key investment decisions have been completely codified – the fund simply replicates a pre-defined index the rules of which capture all three components of the first stage. It is thus clearly systematic in the first part of the investment process. Given the importance of tracking the index as closely as possible it is almost always also implemented on a systematic basis as well. It would thus be correct to call them systematic investment products. Similarly, high frequency trading can be viewed as completely systematic as the investment rules and their implementation is completely automated.

On the other hand, most actively managed funds are discretionary – both in terms of the “What to do?” and the “How to do it”. Factor-based equity funds are systematic as their ‘What to do?” is predefined to ensure their continued exposure to the desired equity characteristic. Their application of these rules may or may not be systematically implemented, however.

What does systematic investing mean to CCM?

Our approach to fund management is firstly, to have a very clear specification of our responses to the three key investment decisions. We have clear rules on each of these decisions and are completely ‘systematic’ in the implementation of them.

While our key decisions could be codified (in fact they are in our backtesting and order generation), we recognize that they fit some market environments better than others, so we are active in that we explicitly try and improve them over time.

Where we are completely systematic, however, is that we follow a disciplined, consistent, application of our entire investment approach – particularly the risk budgeting and position management. To use a sporting analogy, it is the combination of process and discipline in terms of its implementation that gives the best chance of success.

Use of technology is key here. Like in the auto industry, technology has significantly improved the ability of drivers to get from A to B more safely and efficiently. Examples include the evolution of brakes from drum brakes to disk brakes to Anti Brake-lock Systems (ABS) and the provision of fuel via the carburetor, then fuel injection and currently auto-stop/start. In each case improved technology has led to better outcomes. It is the same in investing. With modern portfolio management systems, we can (and do) automate the risk budgeting and position management routines. This maximises the chance of achieving the desired investment outcomes.

This also gives us confidence in the results of our back-testing being a good approximation of the pattern of returns that should follow the application of our investment process.

Which is better?

Both systems have some key advantages and disadvantages. Discretionary decision making is potentially good in that every day is different to the last one to some degree and so having the flexibility to be able to respond to these differences appropriately is (potentially) useful. The problem, of course, is that this usefulness is completely dependent on the quality of the discretionary decision maker – can the investment manager really make and implement correct decisions most of the time? Behavioural finance suggests that people in general are not rational economic actors in the way that the efficient market hypothesis assumes that they are. We are gregarious animals and herding emotions cloud logical decision making. Combined with the inherent complexity of the world and the financial market’s reactions makes it a very challenging problem that most discretionary managers do not seem to be able to manage very well.

Systematic investment approaches have the advantage of removing the need for effective decision making on the fly and their consistent application means that the probability of achieving the expected pattern of returns is maximised. They are, however, open to the potential problem of being an inappropriate set of rules for any specific context. They thus run the risk of being consistently wrong if the future turns out to be consistently different to the world that they were designed for. The challenge then is for them to evolve appropriately with the future as it evolves over time.

Conclusion

Effective investing is about applying good judgement around the three key investment decisions, and then implementing this judgement consistently. In our case, years of experience and judgement have gone into the design of the investment process used in the management of our portfolios. However, it is the consistent application of the necessary risk budgeting and position management protocols or processes that turns these into reliable risk-adjusted returns. That is where being systematic is important and so that is why we are systematic.

Author: Andy Pfaff and Professor Evan Gilbert

Download a PDF version of this article.