2024 01 – Analysis of the commodity supercycle

Commodity Supercycle: “a decades long, above trend movement in a wide range of base material prices” (Erten & Ocampo).

The typical catalyst for a commodity supercycle is the interaction of unexpected, persistent and positive demand shocks with a slow-moving supply-side response.

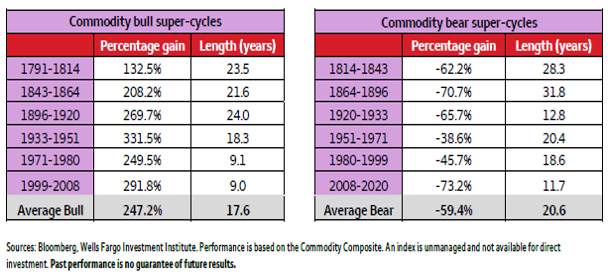

Analysts and strategists are similarly grappling with the question of whether resurgent demand and insufficient supply will create a new commodities supercycle – a view espoused by multiple commodity producers and endorsed by the likes of Goldman Sachs and JP Morgan. Commodity supercycles are rare, but long-lasting. Since the mid-19th century, there have been just four supercycles – each underscored by major historical events.

Commodity Supercycles 1899 – 2020

Commodity bull & bear supercycles

The most recent supercycle, which started in 2000, was driven by urbanisation, investment, and an ascendant middle class in emerging markets – most notably China – and was ended by the 2008 global financial crisis.

Proponents of a new supercycle argue that commodity prices will be driven by stimulus spending, which places greater emphasis on job creation and environmental sustainability than on inflation control, as well as on spending in China, rising inflation, and a weaker dollar. This macroeconomic backdrop should ultimately prove to be more supportive of real assets like commodities than financial assets.

Commodity bulls also anticipate that the global transition to clean energy will generate a persistent supply gap, reinforcing the supercycle. Significant infrastructure investments as the world reduces its reliance on carbon should drive up demand of several raw materials, including aluminium, copper, silver & zinc. Copper in particular has been identified as a key beneficiary of the push for a green future as it is essential for electric cars, solar panels, wind turbines and 5G infrastructure.

Sceptics argue that while commodity price cycles are common, supercycles are different – requiring a fundamental shift in demand or supply to ensure elevated prices for an extended period. Rather than a new supercycle, these analysts argue that the current commodity boom is merely a cyclical recovery driven by restocking in the US, China, and Europe – with prices boosted by supply disruptions. Furthermore, supercycles typically only occur every 30 to 40 years, while the last one ended just over a decade ago.

What is the market thinking?

As of 2024, there are differing views on whether the global economy is currently experiencing a commodity supercycle.

According to ING’s Commodities Outlook for 2024, there is cautious optimism for the commodities market. They observed that commodities were the best-performing asset class in 2021 and 2022, but faced challenges in 2023 due to various factors including Europe’s mild winter, sanctions and trade adjustments related to Russia’s invasion of Ukraine, China’s economic issues, and central bank tightening. For 2024, they predict moderately supportive conditions for commodities, driven by factors like heightened geopolitical tensions and expectations of a weaker US dollar. They also foresee specific developments in oil, European natural gas, US natural gas, metals, and agricultural commodities.

On the other hand, Richard Mills from Ahead of the Herd points out that the current scenario of peaking supplies in several commodities, such as copper and silver, coupled with high demand, could indicate the early stages of a new supercycle. He emphasizes that insufficient investment in the last commodity cycle is now being challenged by the demands of the clean energy era, leading to potential years of market deficits. High inflation is also seen as a definitive indicator of a commodity supercycle.

The World Bank provides a more measured perspective, noting that commodity prices rose 5% in the third quarter of 2023, driven by a surge in oil prices. They project that oil prices will average around $81 per barrel in 2024, with natural gas prices in Europe and the U.S. expected to decline. Agricultural prices are also expected to fall in 2024 due to ample supplies. However, the demand for critical minerals used in electric vehicle and battery production, like cobalt, lithium, and molybdenum, is expected to continue soaring.

VanEck, a global investment manager, suggests that the longer-term bull market in commodities could resume in 2024. They highlight challenges in supply as the world transitions to renewable energy sources and the impact of global geopolitical conflicts on supply and resource security risks. They expect increased global commodity demand in 2024, driven by factors like potential easing of the U.S. Federal Reserve’s monetary policy and global growth outside the U.S..

However, S&P Global asserts that the current commodity market conditions do not meet the requirements of a supercycle. They argue that commodity markets are currently grappling with a series of historic economic shocks that have not subsided and that an acceleration in the transition to lower- or zero-carbon energy sources is more likely to lead to a new commodity supercycle in the future.

In summary, while there are signs of increased demand and supply constraints in certain commodities, the overall picture is mixed, with various factors influencing the global commodities market in different ways. Whether the current situation qualifies as a supercycle is subject to ongoing debate among experts and market analysts.