Andy Pfaff argues that asset allocators should consider exposure to physical commodities and not just resource stocks.

For an economy built on commodities, South African investment portfolios hold surprisingly few commodities. You may see a lonely gold ETF, but the rest of the commodity allocation is generally made up of resource equities.

As much as you may hope, resource equities don’t provide the same benefits as a direct investment in commodities. Take for instance the price action in Gold Fields. On the 31st of May 2022, the stock lost 19.78% versus the gold price which was only down 0.28%.

Commodities should be considered as their own distinct asset class and with generous allocations of 10% allowed by both CISCA and Reg. 28, it isn’t one we should be ignoring. We tend to think either commodities or resource equities, but when it comes to diversification, it should be both commodities and resource equities.

Commodity price movements explain very little when it comes to resource equity price changes, as they frequently respond very differently to the same drivers at different phases of the business cycle.

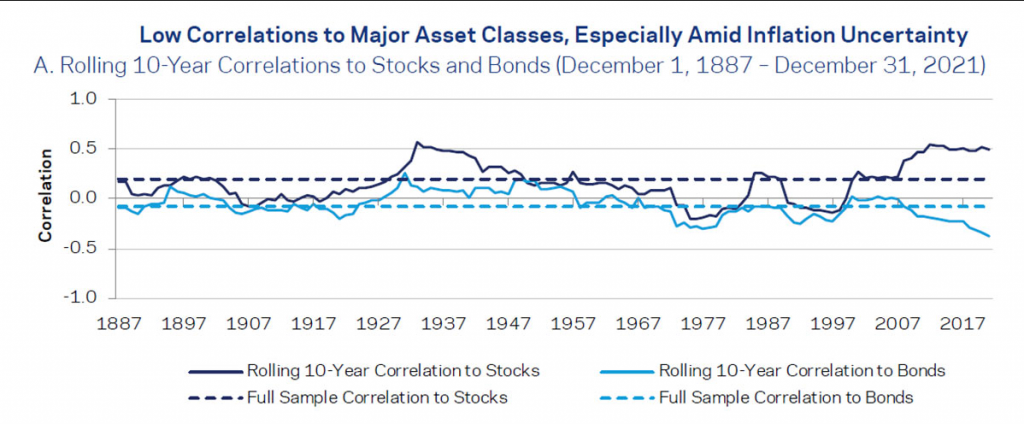

One of the biggest advantages of including direct commodities within your portfolio, is the low correlation to traditional assets like bonds and equities. When you compare a commodity index to a resource equity index, or gold and platinum shares to the gold and platinum price, the correlation (R²) is seldom greater than 0.25.

Commodities can therefore play an important role in any strategic asset allocation and the improvement of a fully diversified portfolio’s risk adjusted return.

Source: AQR

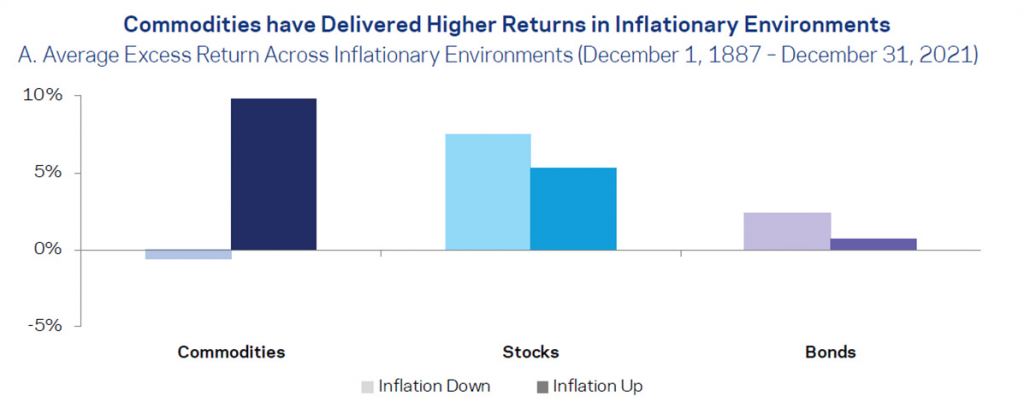

Most investment targets are inflation-based, and commodities are actually one of the few investments that offer consistent protection against inflation. This is also intuitive as inflation consists of goods and services, and commodities are the goods.

Source: AQR

Agricultural commodity prices are driven by the weather, energy prices by politics and metal prices by economics.

– Sandra Gordon (Coherent Commodities consulting economist, 2017)

The current market conditions, with geopolitical challenges running rampant and global fiscal stimulus making the reflation trade topical, strongly suggest a significant tactical allocation to commodities.

However, commodity indices do not have the typical Darwinian bullish bias of equity indices, where the strongest constituents are upweighted and the weakest rejected from the basket.

Therefore, in an environment where commodity prices cycle through bull and bear markets, the cross-sectional volatility between the broad commodity sectors of agriculture, energy and metals and their underlying individual constituents require active risk management in order to harvest alpha in excess of that on offer from the asset class beta.

All put together, adding the conditional correlation of an actively risk managed, diversified commodity portfolio to a traditional portfolio can materially improve the total portfolio’s risk adjusted returns.

Source: